how are property taxes calculated in broward county florida

115 South Andrews Avenue Room 111. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Broward County Property Tax Consultants Lower Your Property Taxes With Property Tax Professionals

Room A100 115 S.

. Census Bureau American Community Survey 2006. Broward County Tax Calculator. Recording Fee Documentary Tax Calculator.

The estimated tax amount using this calculator is based upon the average. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax.

954 357 6830 Phone. This tax estimator is based on the average millage rate of all Broward municipalities. Broward County collects on average 108 of a propertys.

Lands Available for Taxes LAFT Latest Tax Deed Sale Information. The median property tax in Broward County Florida is 2664 per year for a home worth the median value of 247500. Andrews Ave Fort Lauderdale 830am 5pm M-F either full or partial payments by cash check credit or debit cards fees apply.

Calculation for Recording Fee. Recording Fee Documentary Tax. At the Tax Collectors Office.

Broward County FL Property taxes must be paid no later than March 31 of the following year to avoid delinquency interest fees and penalties but may be paid as early as November 1 of the. Fire or Going Out Of Business Sale Permits. Under Florida law e-mail.

The Broward County property tax rate is 108 of home value making property taxes in this county slightly higher than Floridas state average of 097. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist. Typically Broward County Florida property taxes are decided as a percentage of the propertys value.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Broward County Property Appraiser. Fort Lauderdale Florida 33301.

Broward County Governmental Center. For comparison the median home value in Broward County is. How Property Tax is Calculated in Broward County Florida.

Calculation for Deed Doc Stamps or Home Sale Price. Property taxes have always been local governments very own domain as a revenue source. Broward County Property Appraisers Office - Contact our office at 9543576830.

This estimator is a tool which does not capture every scenario of how Portability is calculated by our office. If you think your. Search all services we offer.

Together with Broward County they rely on real property tax receipts to carry out their public. We are open weekdays from 8 am until 5 pm.

Broward County Property Tax Consultants Lower Your Property Taxes With Property Tax Professionals

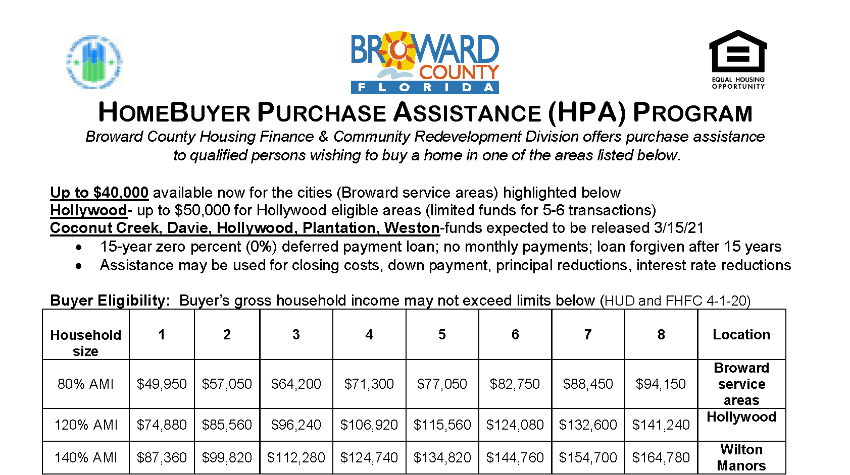

Broward County Resources Housing Foundation Of America

Broward County Property Appraiser

Explaining The Tax Bill For Copb

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Taxsys Broward County Records Taxes Treasury Div

Broward County Fl Property Tax Search And Records Propertyshark

Home Seller S Net Proceeds Calculator Broward County Fl

Broward County Property Appraiser How To Check Your Property S Value

Broward County Property Appraiser

Property Taxes In Florida Globalty Investment

Florida Property Tax Calculator Smartasset

All Broward Cities Raising Taxes But Total Bill Could Fall Sun Sentinel

How Long Can Property Taxes Go Unpaid In Broward County South Florida Reporter